How Mercury is winning startup banking with a $3.5 billion valuation through clear positioning and community led growth 🪐

Banking for what startup founders are building ✨

This spring I had the pleasure of attending Mercury’s SPHERES conference—and as a Mercury user, I was struck by something I don’t usually say about a financial services company: they’re building brand right.

👋 Hi, I'm Amanda. I'm a brand strategist and fractional CMO. I help complex businesses turn belief into scalable brand operating systems—and brand into a strategic asset. I share weekly deep dives with actionable advice on brand building, interviews with the people in the trenches, and tools you can actually use. Book a chat here.

Who will love this

Fintech marketers earning trust in a skeptical space

Community-led growth marketers

Founders asking: When do we bet on brand—and what does “right” even look like?

Today

G’day 👋

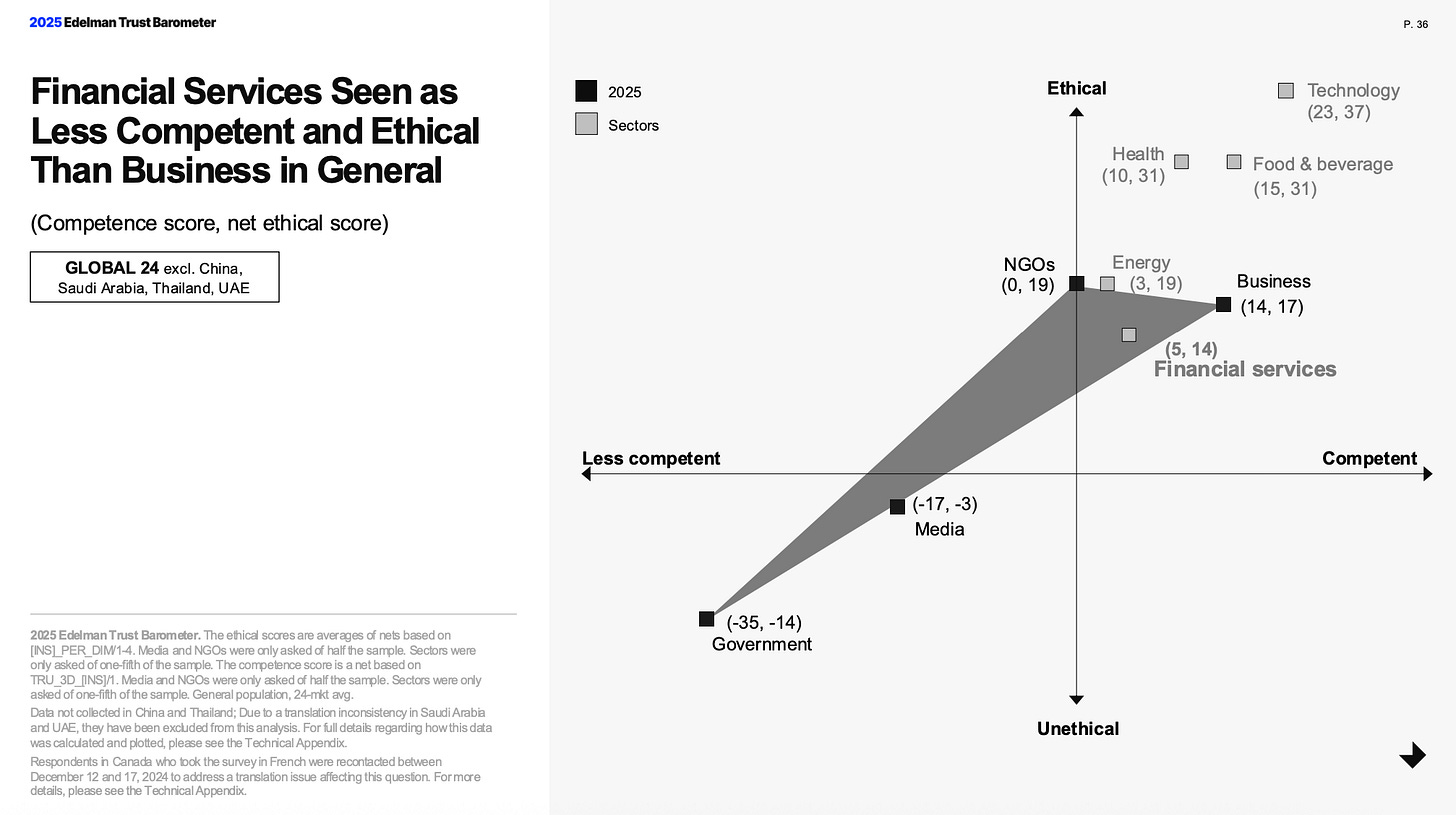

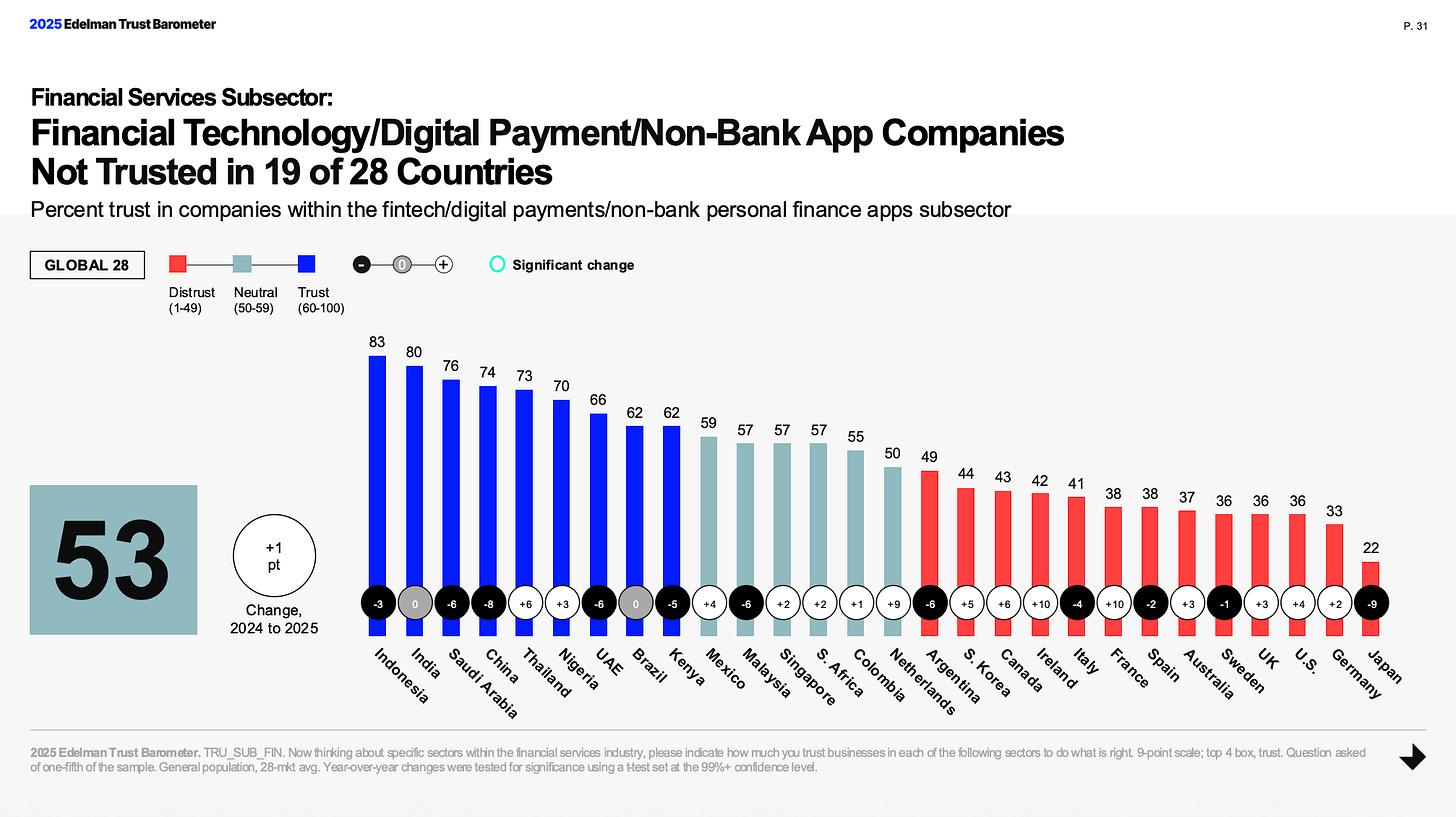

One of my favorite things is working on challenger brands in a category that’s historically low-trust. Brand has a huuuuge opportunity to drive growth here since the bar is low and most competitors can’t or won’t invest in building awareness in the ways that matter. Most companies wait until they’re “big enough” to invest in brand…then they go out with big bad (bland) ads that don’t speak specifically to their ICP and are surprised when they don’t perform.

So yeah, banking! When I started consulting a few years ago I had to wade through the absolute trashfire user experience of setting up a business. LegalZoom, Honeybook, Stripe, Paypal, Washington State department of revenue, the IRS(!) - some steps of the journey better than others, all confusing, very few of them beautiful or aligned with the type of business I wanted to build. When I was recommended Mercury, I chose it for ease of use and the $0 a month fees. Fast forward two years later, I’ve upgraded to Mercury ‘Pro’ (thank you to their lovely invoicing feature), attended their conference, and now here I am talking to you as a big-time brand fan.

Mercury is a reminder that brand at its best is far more than a fancy identity system: it’s a clear point of view on the world, a deep understanding of what your people need — and a story, mechanism, and system to give it to them at the right point in their particular customer journey. For Mercury, I see clarity showing up in a sharp understanding of what their customers—startup founders and small business owners—actually need: not just better banking tools, but inspiration, connection, and a brand that treats them like the heroes of the story.

Let’s get into it!

P.S. HUGE thank you to everyone who’s already taken The Case reader survey. Last chance to get your submissions in & shape what’s next; I’ll close the survey July 31.

✌️ Amanda

Business strategy: Banking designed for founders, built by one

Mercury: For startups, by a startup founder

Research tells us that founder-led brands tend to outperform other brands. I’ve worked in a number of founder-led businesses & have experienced this directly - the benefit of working in a company where the vision is singular and leadership is single-threaded is a serious advantage against incumbents in business building and brand building. Founders also tend to have a greater appetite for strategic brand building; whereas incumbents, in my experience, bias for category conventions and consensus. IYKYK. 🤷♀️

Mercury’s founder, Immad Akhund, is a YC alum & a serial entrepreneur who started the company out of personal frustration dealing with banking as a startup founder—traditional banks weren’t built for how startups operate. That pain point wasn’t just aesthetic or UX-related. It was fundamental: banking wasn’t designed for modern, venture-backed businesses.

Mercury’s challenge to the industry was simple but ambitious: what if banking were designed to actually support & inspire startup founders?

To make a long story short, they solved it with an obsessively founder-first UX and product roadmap. I’m a bit of a finance junkie and I’ve played with and worked on a number of financial services including peer-to-peer lending apps, investing apps, investing apps for women, ethical investing, shareholder advocacy investing apps, foreign exchange trading software, and I have to say Mercury is hands down the best experience I’ve had with a financial service to date. They announced personal banking at their Spheres conference this year and after many years with one of the big (bad) four banks, I’m excited to switch.

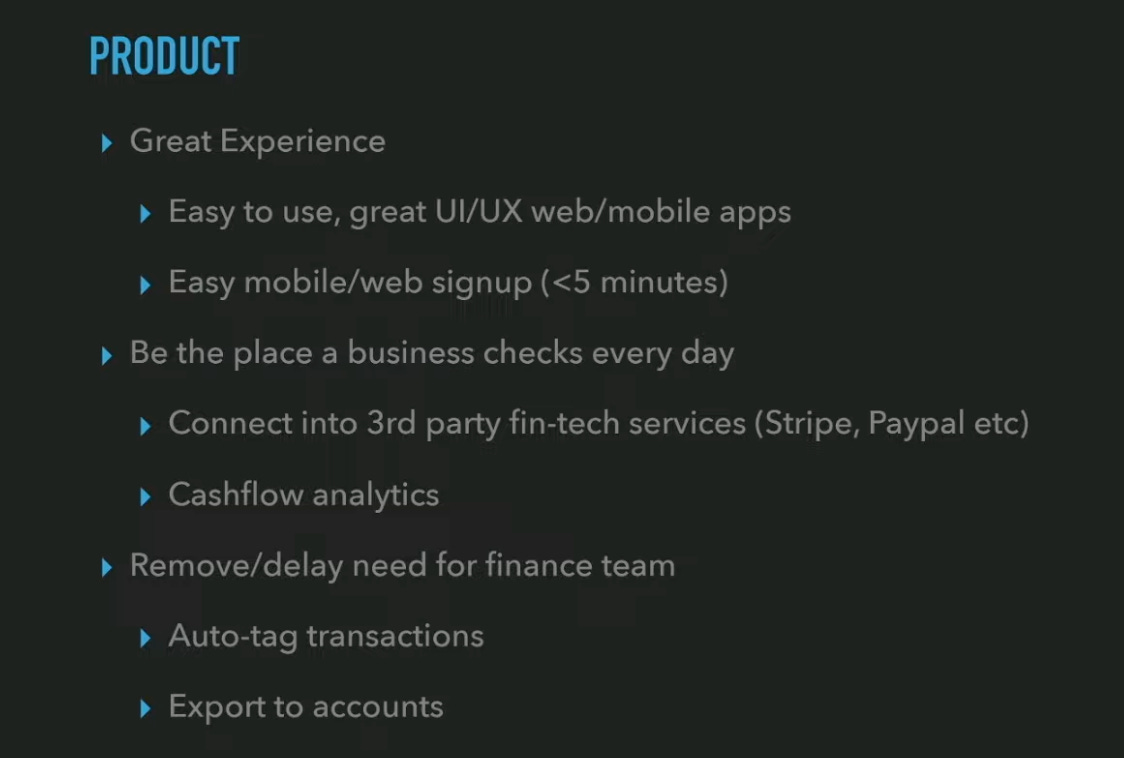

Here’s their

Improve the core experience of banking. The experience of banking has so many artificial limitations that don’t need to be there - and a lot of missing moments that should be included.

Example: getting a business credit card is a real moment for someone. That moment should be celebrated in the customer experience!

Bring together all the ways you use money. Before Mercury, you had to use separate tools for invoicing, working capital, cards, billpay, reimbursement, SAFE. Mercury’s features bring it all together.

Example: Mercury’s invoicing features have made my life 1 million times easier. My previous software was…making me tear my hair out. Then I wondered why I had to use two different tools to bank and invoice. I don’t anymore!

Enable collaboration with control. For startup founders in scaling mode, your tools need to scale with you — setting different levels of controls, offboarding employees aren’t built into traditional banking systems

Example: controls around employee cards, category locking for credit cards - for example you could give access to an employee to spend only on an ‘office supplies’ category. Cool!

Drive deep insights into your business. Can traditional banking give you unparalleled insight into you money? See top sources of spend and revenue by vendor and category? OF COURSE THEY CAN’T. Who can? Mercuryyyy, baby.

Example: Perfect example - trying to pull transactions beyond 90 days is difficult with traditional banking.

Make banking personal. Mercury launched personal banking with all of the same features described above - the ability to invest, collaborate, understand where your money is going. I am personally really excited about this.

Example: Right now - I use three different apps. One for my banking, one for investing, and one for budgeting and tracking spend. Why!? Next: I plan on switching to Mercury (and no, this isn’t a paid ad, just a good product).

Financial services are not exactly renowned for its ethics or competence. Mercury, on the other hand, is growing through recommendations: their customer survey data showed that nearly half of customers first learned about Mercury from a friend, fellow founder, or investor in your network. And that is why community-led growth is so darn powerful. Would you rather grow through traditional media like paid ads, borrow trust from partners, or through the personal recommendation of someone you already know, like and trust? Rhetorical question, of course!

Mercury aren’t just earning deposits. They’re expanding their share of founder workflows, a place in the “stack” of entrepreneurs and early adopters. That’s business strategy—and brand strategy—working together.

Ready to build your brand into a growth engine?

I work with business owners & marketers who want to build their brand strategy into their operations. If you’re trying to build more than a logo (and I know you are if you’re reading this newsletter), an audit & jump start might be the next right step.

I have 1 more spot open this quarter.

Brand strategy: Banking for what you’re building

Brand strategy’s job is to support business strategy. From the outside looking in, Mercury’s business strategy has been to grow through early adopters: startup founders. This is what I see when I look at Mercury: a strong point of view on the world. Mercury believes that banking should make you feel unstoppable. So if I’m assessing brand marketing for Mercury, I’d ask: what can we do to make founders feel unstoppable? How would we behave then?

That’s the sauce. What does Mercury have to do to make that a reality? This is where the rubber meets the road on brand building: what are the things you’ll commit to doing over a period of years that will build a particular place in people’s minds?

Brand or strategic principles are where I like to get really pointy on the things a company needs to do over and over again to occupy the positioning they’re chasing (banking for what you’re building).

Strong brand principles:

✅ Commit you to actions that cement your desired positioning in people’s minds

✅ Can be executed over many years

✅ Are things competitors can’t do or won’t invest in1️⃣ Inspire entrepreneurial dreams

Mercury knows founders and builders don’t just want tools. They want to become the kind of founders they admire. I love it to see a company getting clear on customer psychographics — in my experience that’s where the good stuff is. Mercury’s great at speaking to & executing on what founders — who are notoriously time poor: want & need.

Example: The Spheres conference delivered advice from successful founders talking about their early days in the trenches—casting a vision of what’s possible. Smaarrrt.

2️⃣ Curate connection

Mercury’s marketing is the opposite of traditional banking: they behave more like a startup accelerator than a bank by building a community around the product. Mercury treats their community like a product and has had Mallory Contois, legendary community builder and operator at the helm for the past few years now.

Example: Mercury’s community AMAs and guests bring credibility and aspiration (like an expert session with the legendary Amanda Goetz!)

3️⃣ Raise expectations in a low-trust industry

Financial services have been slow, rigid, and extractive for decades. Mercury flips the script on one of the most hated industries going with a delightful product, clear, useful communication, and an experience that’s additive — not extractive. Their brand isn’t just what they say— it’s how they behave. The experience is the brand.

+ Example: Their brand tone is all signal, no corporate filler. Who needs daily emails from their bank? Not me. But…I love Mercury’s monthly emails which are CHOCK full of tools, events, and useful information for startup operators. Programming that’s tied to the identity people desire (successful founders). I actually can’t wait to see what comes next from Mercury. Who says that about their bank? 🙋♀️

What can we learn from Mercury?

If you’re building a brand in fintech, B2B, or any category where trust is tough to earn, Mercury is a case worth studying. Here’s how to apply three key lessons to your own brand:

1. Get crystal-clear on your positioning early.

If your founder has a sharp point of view, use it to anchor the brand. A clear, consistent narrative can build trust faster than waiting for the brand to “mature.”

2. Go beyond utility—solve higher-order needs.

Features keep you competitive; understanding the deeper outcomes your customers want (security, status, credibility, growth) makes you sticky.

3. Tie community and content directly to the business.

When aligned, they drive word-of-mouth and retention. When they don’t, they’re expensive distractions. Audit where your efforts connect to acquisition, engagement, or revenue.

Quick self-check for your B2B brand OS:

Do you know your customers’ higher-order needs?

Is your content tied to a strategy—or just filling channels?

Are your community efforts directly connected to product or business metrics?

The takeaway: product features can be copied. A well-anchored identity—and a brand ecosystem built around it—can’t.

Three ways I can help you

When you’re ready, here are three ways I can help you:

Follow me on LinkedIn. If you liked what you read here, you’ll love hearing from me three times a week yapping about brand.

Book a paid brand marketing audit. For founders and marketing leads who are tired of random acts of marketing, I run flat-fee brand audits that give you a clear picture of what’s working & what’s wasted effort. Strategic directions for your channels, messaging & content.

1:1 power hour. Whether you need a focused power hour to get unstuck on a strategy project or a partner to help co-build your brand operating system, I can help you turn scattered efforts into a cohesive engine that drives results.

That’s all! 👋

Subscribe to The Case

Haven’t subscribed yet? I drop brand deep dives & tools every Friday at 6AM, just in time for a chill Friday coffee to clear out the cobwebs and get a little brand inspiration in your inbox.

The Case is read by thousands of people in 41 states, 70 countries by people who work at killer brands and brand studios like the following companies. Get amongst it.

Stay cool,

— Amanda